In the rapidly evolving world of cryptocurrencies, the decision to invest in the right mining machine can be both exhilarating and daunting. Cryptocurrency mining is no longer a niche hobby; it has matured into a sophisticated industry where efficiency, power consumption, and hardware reliability dictate the success or failure of mining operations. For those eyeing the lucrative prospects of Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOG), and other digital currencies, picking the perfect mining rig is paramount. When considering the US market—a thriving hub with competitive electricity costs, hosting availability, and regulatory nuances—understanding both the technical and economic landscape is key to maximizing returns.

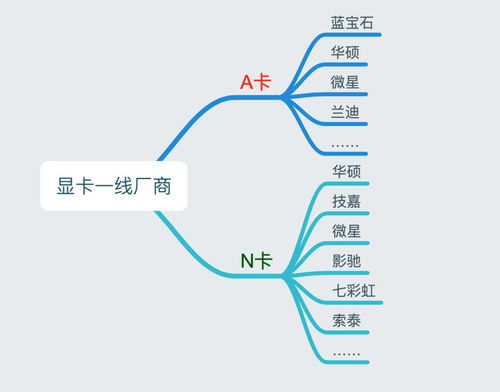

The realm of mining machines—from Application-Specific Integrated Circuit (ASIC) miners to versatile graphic processing unit (GPU) rigs—offers distinct advantages and trade-offs. ASIC miners, often synonymous with Bitcoin mining, are engineered for a single algorithm, delivering unmatched speed and efficiency. Conversely, GPU rigs afford flexibility, being capable of mining various altcoins like Ethereum and Dogecoin, and adapting as mining algorithms evolve. The decision hinges on the targeted cryptocurrency and long-term strategy. For Bitcoin enthusiasts, the well-known Antminer series or MicroBT’s Whatsminer line dominate due to their top-tier hash rates and energy efficiency. ETH miners gravitate toward high-end GPUs like NVIDIA’s 30-series cards, which excel not only at Ethereum’s Ethash algorithm but also empower hosting services by providing multi-coin mining capabilities under one roof.

Hosting mining machines—leasing space, power, and cooling in specialized facilities—has gained remarkable traction, especially in the US, where cheap and abundant power sources from hydroelectric, wind, and solar plants fuel entire mining farms. Hosting amplifies profitability by removing the hassle of managing hardware personally. Investors can avoid the intricacies of fluctuating electron tariffs, hardware maintenance, and network stability. Mining farms equip miners with optimum environmental conditions, regulated temperatures, and continuous uptime, which are critical for the high-stakes mining of BTC and ETH. As cryptocurrencies fluctuate, having a reliable hosting partner mitigates operational risks and enables miners to focus on market movements rather than machine upkeep.

Delving deeper, hosting services often offer tiered packages tailored to the miner’s scale: from small scale operations with a handful of machines to massive institutional setups boasting thousands of rigs. Beginner miners might dip into shared hosting to gain exposure without prohibitive upfront costs, while seasoned miners invest in dedicated slots to maximize returns. Moreover, hosting is heavily influenced by regional US legislation, particularly concerning environmental impact and electricity consumption caps—variables all miners must weigh before committing their capital.

Cryptocurrency exchanges intersect closely with mining operations. Miners frequently convert freshly minted coins via exchanges to hedge against market volatility or to capitalize on price surges. For instance, while Bitcoin, renowned for its pioneering blockchain, demands robust ASIC miners, Dogecoin miners often prefer efficient GPUs or multipurpose rigs adaptable to Scrypt or auxiliary proof-of-work algorithms. ETH miners face a pending transition toward Ethereum 2.0’s Proof of Stake (PoS), which threatens the traditional mining ecosystem. Yet, alternatives like staking or pivoting toward other mineable coins keep miners on their toes. Proactive miners therefore diversify their portfolios, frequently switching mining algorithms or pooling resources to ride the unpredictable waves of crypto market cycles.

When selecting a mining rig, it’s crucial to consider the total cost of ownership beyond the initial purchase price. Energy efficiency often proves the greatest determinant of profitability; a machine with higher wattage consumption may underperform when electricity costs—critical in any US state—are factored in. Hardware longevity and warranty terms also influence purchase decisions, especially for miners who plan to operate their machines intensively over years. Given the rapid innovation cadence in mining technologies, some opt for leasing arrangements from manufacturers or hosting providers to stay agile. Additionally, miners must evaluate the noise footprint and physical space requirements, as these impact hosting logistics and residential mining setups alike.

In sum, marrying the technical specifics of mining rigs with strategic hosting choices and market dynamics defines the modern miner’s pathway to success. The US remains a fertile ground for growth, whether tapping into expansive mining farms, negotiating favorable electricity deals, or integrating closely with dynamic crypto exchanges. By blending expert advice, robust machines, and strategic hosting plans, crypto enthusiasts can optimally position themselves in a fiercely competitive yet rewarding industry. As the blockchain universe expands, those who adeptly navigate hardware, hosting, and market pulsations are set to harvest not just coins, but a prosperous future.