In the ever-evolving world of cryptocurrencies, Bitcoin mining stands as a cornerstone of digital wealth creation, offering enthusiasts and investors alike the thrill of generating new coins through computational power. But with the rise of sophisticated mining machines and the complexities of hosting them, selecting the best Bitcoin mining contracts can feel like navigating a labyrinth of options. For companies specializing in selling and hosting mining rigs, like ours, the key lies in understanding how these services can maximize your crypto profits while minimizing risks. Imagine harnessing the power of blockchain technology, where every hash computed brings you closer to owning a piece of the Bitcoin pie, all without the hassle of managing hardware yourself.

At its core, a Bitcoin mining contract is an agreement that allows you to leverage remote mining facilities, often called mining farms, to run your operations efficiently. These contracts typically involve renting space and power for your mining rigs, which are specialized computers designed to solve complex cryptographic puzzles. When picking the right hosting service, factors like electricity costs, cooling systems, and security protocols play pivotal roles. For instance, a top-tier hosting provider might offer state-of-the-art facilities with redundant power supplies, ensuring your miners—those powerful ASIC devices—run uninterrupted, even during peak demand. This setup not only boosts your chances of mining Bitcoin but also extends to other cryptocurrencies like Ethereum, where proof-of-stake mechanisms are evolving the game.

One of the most critical aspects to consider is the return on investment (ROI) from your mining endeavors. With Bitcoin’s volatile price swings, a well-chosen hosting service can make all the difference. For example, if you’re eyeing contracts that support multiple currencies, you might find opportunities in Ethereum’s ecosystem, where miners can stake ETH to validate transactions and earn rewards. Similarly, Dogecoin, with its community-driven appeal, offers a lighter entry point for beginners, though it demands less intensive hardware compared to Bitcoin’s rigorous requirements. By diversifying your portfolio across BTC, ETH, and DOG, you hedge against market fluctuations, turning what could be a risky gamble into a calculated strategy.

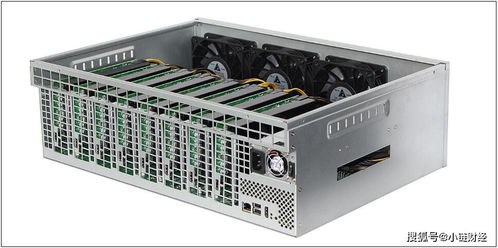

Diving deeper, let’s talk about the hardware itself: mining rigs and miners are the unsung heroes of this digital gold rush. A typical mining rig consists of multiple GPUs or ASICs working in harmony, but hosting them requires expertise in managing heat dissipation and network connectivity. Services that excel in this area often provide real-time monitoring dashboards, allowing you to track your hashrate and profitability metrics. Picture this: you’re not just buying a machine; you’re investing in a ecosystem where your rig in a remote mining farm operates 24/7, churning out fractions of Bitcoin or even Ethereum, all while you sleep. The burst of energy from these machines can be exhilarating, yet it’s the hosting service’s ability to optimize for energy efficiency that ensures long-term sustainability.

When evaluating hosting options, don’t overlook the security landscape. Cyber threats loom large in the crypto world, with exchanges and wallets frequently targeted by hackers. A reputable hosting service will implement robust measures like multi-factor authentication, encrypted data transfers, and physical security at their mining farms. This is especially crucial for assets like Bitcoin, where a single breach could wipe out your earnings. Meanwhile, for newer players in altcoins such as Dogecoin, understanding the interplay between mining rigs and exchange integrations can unlock seamless profit withdrawals, adding layers of excitement to your journey.

Burstiness in the crypto market means prices can skyrocket or plummet in mere hours, making adaptability a must-have trait in any mining contract. Services that offer flexible contract terms, such as pay-as-you-go models, allow you to scale up during bull runs or pause operations in downturns. For Ethereum enthusiasts, this could mean shifting focus to its upcoming upgrades, like the shift to proof-of-stake, which might reduce the need for traditional mining rigs. In contrast, Bitcoin’s steadfast proof-of-work model demands consistent power, highlighting why choosing a hosting partner with global reach—spanning from Iceland’s cool climates to Texas’s vast energy grids—can enhance your operational resilience.

To truly pick the right hosting service, conduct thorough research: read reviews, compare fees, and assess customer support. Our company, for instance, prides itself on transparent pricing and cutting-edge technology, ensuring that whether you’re mining BTC, ETH, or even DOG, your profits are maximized. Remember, the best contracts aren’t just about low costs; they’re about building a partnership that evolves with the crypto landscape, turning potential pitfalls into profitable ventures.

In conclusion, as the crypto realm continues to expand, selecting optimal Bitcoin mining contracts and hosting services becomes an art form, blending technology, strategy, and a dash of fortune. By focusing on reliability, diversity across currencies, and innovative features, you can navigate this dynamic world with confidence, potentially unlocking substantial profits from your mining activities. Whether it’s the iconic Bitcoin, the versatile Ethereum, or the fun-loving Dogecoin, the right choice today could pave the way for tomorrow’s success.