France, a land renowned for its exquisite wines, delectable cheeses, and rich history, is increasingly becoming a player in the burgeoning world of cryptocurrency mining. As digital assets like Bitcoin, Ethereum, and Dogecoin gain mainstream traction, the demand for mining infrastructure continues to surge, prompting individuals and institutions alike to explore the profitability of deploying mining machines within French borders. But navigating this landscape requires a nuanced understanding of factors that significantly influence mining yields, from electricity costs to hardware efficiency.

The allure of cryptocurrency mining stems from its potential to generate passive income. By dedicating computational power to verifying and adding transactions to a blockchain network, miners are rewarded with newly minted coins. However, the profitability of this endeavor hinges on a delicate balance between operational expenses and the value of the mined cryptocurrency. In France, electricity costs represent a significant overhead. Regions with access to cheaper energy sources, such as those leveraging renewable energy or proximity to nuclear power plants, offer a distinct advantage to miners seeking to maximize their returns.

Beyond electricity, the choice of mining hardware is paramount. Application-Specific Integrated Circuits (ASICs) are purpose-built machines designed to efficiently solve the complex algorithms required for mining specific cryptocurrencies like Bitcoin. Their specialized design allows them to outperform general-purpose CPUs and GPUs, resulting in higher hash rates and greater mining potential. However, ASICs come with a hefty upfront investment and are often tailored to a particular cryptocurrency. Conversely, GPUs offer greater versatility, enabling miners to switch between different cryptocurrencies based on profitability. This flexibility can be advantageous in a volatile market but typically comes at the cost of lower overall efficiency.

The performance of a mining machine is measured by its hash rate, which represents the number of calculations it can perform per second. A higher hash rate increases the probability of successfully mining a block and earning the associated reward. Furthermore, energy efficiency, typically expressed as watts per terahash (W/TH), is a critical consideration. More efficient machines consume less electricity for the same hash rate, translating into lower operational costs and higher overall profitability. When evaluating mining machines for deployment in France, miners must carefully consider both hash rate and energy efficiency to optimize their returns.

Mining difficulty, another crucial factor, refers to the computational effort required to mine a block. As more miners join a network, the difficulty automatically adjusts upwards to maintain a consistent block creation time. This means that as the Bitcoin network grows, individual miners must invest in more powerful hardware to maintain their share of the rewards. Ethereum, on the other hand, is transitioning to a Proof-of-Stake (PoS) consensus mechanism, which will eliminate the need for energy-intensive mining. This shift presents both challenges and opportunities for miners who must adapt to the evolving landscape.

The regulatory environment in France is also a consideration. While cryptocurrency mining is not explicitly prohibited, the legal framework surrounding digital assets is still evolving. Miners must be aware of relevant regulations related to taxation, anti-money laundering (AML), and environmental compliance. Furthermore, access to reliable internet infrastructure is essential for maintaining consistent connectivity to the blockchain network. Downtime can result in lost mining opportunities and reduced profitability.

Mining pools offer a way for individual miners to combine their computational power and increase their chances of earning rewards. By pooling resources, miners can share the burden of solving complex cryptographic puzzles and receive proportional payouts based on their contribution. Joining a reputable mining pool can significantly improve the consistency of revenue for smaller miners. However, it’s crucial to carefully evaluate the pool’s fee structure, payout methods, and security measures.

The decision of whether to host mining machines in a dedicated facility or operate them independently is another critical consideration. Mining farms provide specialized infrastructure, including cooling systems, power management, and security, which can be costly to replicate on an individual basis. However, hosting facilities typically charge fees for their services, which can impact overall profitability. Independent miners have greater control over their operations but must bear the responsibility for managing infrastructure and maintenance.

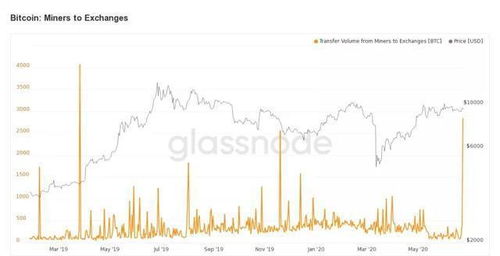

The fluctuating value of cryptocurrencies adds another layer of complexity to the evaluation of mining machine yields. The profitability of mining is directly correlated to the price of the mined cryptocurrency. A sudden price drop can render mining unprofitable, while a price surge can significantly boost returns. Miners must carefully monitor market trends and implement risk management strategies to mitigate the impact of price volatility. Some miners choose to hedge their exposure by converting mined cryptocurrencies into fiat currency or other stable assets.

Beyond Bitcoin and Ethereum, numerous other cryptocurrencies can be mined. Altcoins, such as Dogecoin, Litecoin, and Monero, offer alternative mining opportunities, each with its own unique algorithm and difficulty level. However, the profitability of mining altcoins is often more volatile than that of established cryptocurrencies like Bitcoin. Miners must carefully research the potential of each altcoin and assess the risks involved before investing in mining hardware.

Ultimately, evaluating mining machine yields in France requires a comprehensive assessment of numerous factors, including electricity costs, hardware efficiency, mining difficulty, regulatory environment, and cryptocurrency prices. By carefully considering these variables and implementing sound operational strategies, miners can increase their chances of generating sustainable profits in this dynamic and evolving industry. The rewards are potentially significant, but the risks are equally substantial, demanding a well-informed and diligent approach to cryptocurrency mining in the French landscape.